Digital Signature for Income Tax E-filing

Digital Signature for Income Tax E-filing enables secure and compliant filing of ITRs, audit reports, and statutory forms online. Buy a DSC for Income Tax from MeraDSC Provider to ensure fast approval, legal validity, and seamless authentication for individuals, professionals, and businesses across India.

Send Your Query

Who Needs to Use a Digital Signature for Income Tax E-Filing?

The digital signature certificate (DSC) functions as a mandatory requirement for specific tax payers applying for e-filing of their income tax returns. Users requiring digital signatures include companies as well as Limited Liability Partnerships (LLPs) and individuals or firms when the Income Tax Act (Section 44AB) determines account auditing necessity. The requirement for a digital signature certificate exists for political parties who earn more than ₹50 lakhs along with professionals earning more than ₹50 lakhs during e-filing processes. Individual taxpayers benefit from using a DSC as an extra security method while gaining easier tax filing convenience although the use remains optional for most taxpayers.

Benefits of Using DSC for Income Tax e-Filing

Enhanced Security

A DSC ensures tamper-proof ITR submission, protecting sensitive financial data from unauthorized access. The encrypted signature verifies authenticity, reducing the risk of fraud.

Legal Compliance

Mandatory for companies & audited taxpayers, using DSC fulfills IT Dept. requirements under Section 44AB, avoiding penalties for non-compliance.

No Physical Presence

Eliminates the need for in-person verification—submit your ITR anytime, anywhere, without relying on Aadhaar OTP or postal dispatch.

Prevents Rejection

Reduces errors caused by manual signatures or EVC failures, ensuring smooth acceptance of your ITR by the Income Tax portal.

Long-Term Validity

Class 3 DSCs last 1–3 years, eliminating repeated OTP requests for multiple filings within the validity period.

Audit Trail

Creates a verifiable record for tax authorities, simplifying audits by proving the ITR was filed securely and remains unaltered

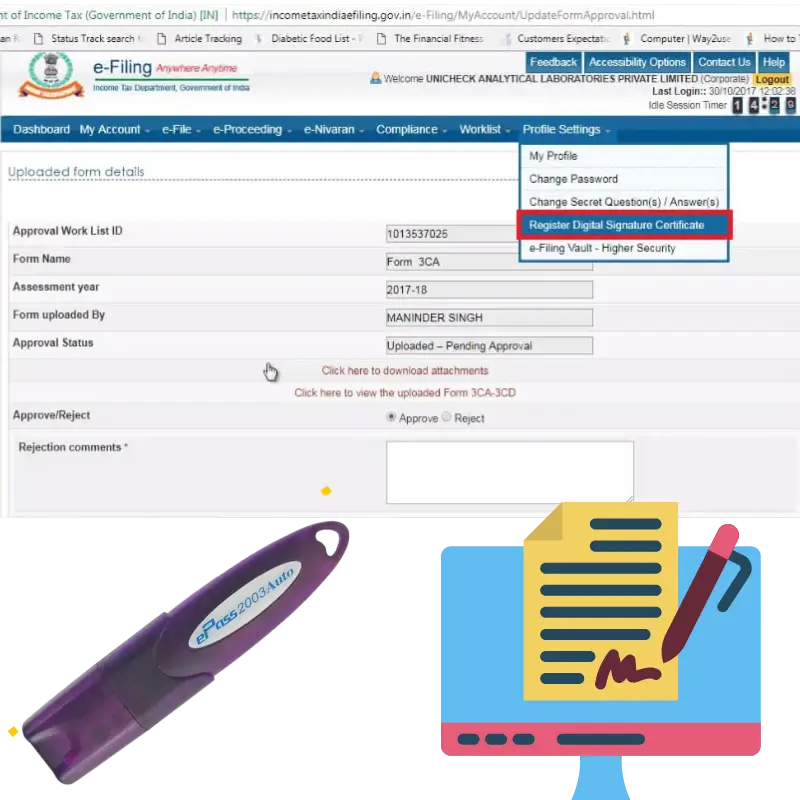

How to Register a DSC on the Income Tax Portal?

Registering your digital signature for income tax filing is crucial. Follow these precise steps:

- Log in to the Income Tax e-Filing Portal using your User ID (PAN), password, and captcha code.

- Navigate to ‘My Profile’ > ‘Register DSC. ’

- Download emBridge if it has not already been done.

- Insert the USB token containing your valid Class 3 DSC.

- Enter the provider, select your certificate, and input the PIN.

- Click ‘Register. ’

Once successfully registered, you will receive a confirmation. The DSC is now ready for filing your ITR.

Frequently Asked Question

A Class 3 DSC with PAN-based authentication is mandatory for e-filing the ITR.

You must renew it; expired DSCs will not be accepted for e-filing.

Yes, most DSCs require a USB token for secure signing. Some providers offer cloud-based options.

Around ₹1,000–₹4,000, depending on the provider CAs and validity period.

Ensure the USB token is properly connected, drivers are updated, and the PIN is correct. Try a different browser.